The business of buying and selling real estate can be a fruitful venture. Real estate agents can earn high amounts of commission income throughout a year. But, unlike a salaried employee, real estate agents are self-employed and do not

have their taxes withheld at the source. Which in turn can lead to large amounts of tax owing at the end of a year.

Thankfully, there is some relief now and finally Ontario has played catchup to what other professionals (accountants, lawyers and doctors) have taken advantage of for a few years. Real estate agents can now setup a Personal Real Estate

Corporations (PREC).

As of October 1, 2020, PREC’s are permitted in Ontario. This will allow realtors who are typically in a higher tax bracket to defer and potentially save on taxes.

Full details on the qualifications can be found on the Ontario Regulation here, but let us go over the criteria below:

Criteria for Personal Real Estate Corporations (PREC):

- The corporation is incorporated or continued under the Business Corporations Act.

- All of the equity shares of the corporation are legally and beneficially owned, directly or indirectly, by the controlling shareholder.

- The sole director of the corporation is the controlling shareholders.

- The president, being the sole officer of the corporation, is the controlling shareholder.

- Each non-equity share of the corporation is,

- legally and beneficially owned, directly or indirectly, by the controlling shareholder,

- legally and beneficially owned, directly or indirectly, by a family member of the controlling shareholder, or

- owned legally by one or more individuals, as trustees, in trust for one or more children of the controlling shareholder who are minors, as beneficiaries.

- There is no written provision by agreement or otherwise or arrangement that restricts or transfers in whole or in part the powers of the sole director to manage or supervise the management of the business and affairs of the

corporation.

You may be wondering what this does for you? Should you incorporate? Here are some of the pros and cons of incorporation you should consider:

Pros:

- Lower corporate tax rate – of 12.2% plus the agent’s personal taxes (depending on how much is withdrawn from the corporation) versus an average of 30% to 40% of personal taxes on entire earnings. (see example

below) - Tax deferral opportunities – this allows you to grow money on tax deferral basis through various investment vehicles.

- Income Splitting – between spouse and anyone else related to you. Need to be aware of TOSI rules (as long as their income reflects their effort or they work a minimum of 20 hrs per week for the business, you

should be okay)

Cons:

- Incorporation Charges – this could range from $1,000 to $2,500

- Higher Account Fees – Corporate filing fees are generally higher

- Stricter Compliance – You be required to submit a T4 or T5 depending on whether you take a salary or dividend during the year

- Primarily for Higher Income Agents – Generally incorporation would be better for an agent who can afford to leave some income in the business at the end of the year.

Here is a simple example for how incorporation can lead to lower tax:

Mr. A realtor in Ontario earning $250,000 of commission and needs approx. $90,000 to support lifestyle.

| Sole Proprietor | Salary | Dividends | |

|---|---|---|---|

| Business Income | 250,000.00 | 250,000.00 | 250,000.00 |

| Less: Salary | – | 148,000.00 | – |

| Less: Corporate Taxes | – | 13,770.00 | 33,750.00 |

| Less: Corporate CPP + EI | 3,754.00 | – | |

| Retained in the Corporation | 232,476.00 | 216,250.00 | |

| Takes salary or dividends of $148,000 | 148,000.00 | 148,000.00 | |

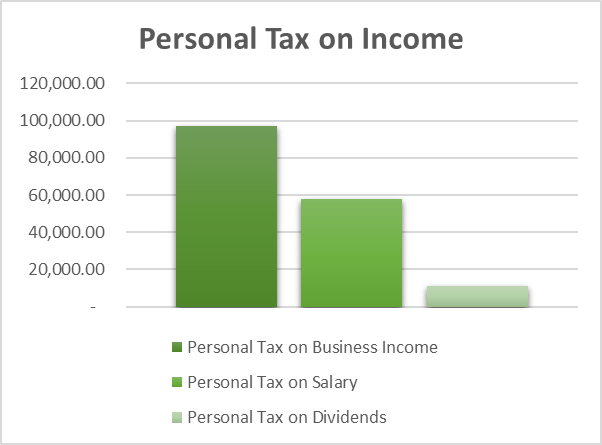

| Less: Personal Taxes | 96,911.00 | 57,720.00 | 11,351.00 |

| After Taxes | 153,089.00 | 90,280.00 | (136,649.00) |

| Target | 90,000.00 | 90,000.00 | 90,000.00 |

| Tax Savings vs. Sole Proprietor | (39,191.00) | (85,560.00) |

Note: Significant savings if dividends taken

You may be thinking that incorporation seems pretty simple and you are your way to enjoying a 12.5% tax rate! However, it’s not that simple and proper steps should be followed.

When you decide to transition from being a sole proprietorship to a corporation, you are really saying that you are shutting down your sole proprietorship. Now, let’s say your business is worth $500,000. When you effectively shut-down

your sole proprietorship to incorporate, CRA may view this a deemed sale to your corporation and will challenge that you sold your business to your corporation at fair market value. Which would mean that you will have to report a

capital gain of $500,000 on your personal tax return! Capital gains are only taxed on the 50% of the full gain. Therefore, you will be taxed on the $250,000. At an average tax rate of 38.76%, This could potentially mean you have a tax

owing of approximately $96,900!

How can you avoid this?

The first step is to figure out what your business is valued at. You can do this by hiring professional to do a valuation (this can be pricey). Or you can also use an earnings multiple of say 5x. If your business consistently makes

$100,000 per year for the last 3 years, you can estimate your business’ value to be $500,000 ($100,000 x 5).

Second, there is a provision in the Income Tax Act, called the Section 85 Rollover. This allows you to transfer at cost instead of its fair market value. Section 85 is a discussion on its own, but simply this will allow you to do the

following:

- You and your corporation can elect to transfer the real estate business at cost instead of fair market value. The cost of your business can be nominal (ex: $100).

- You will need to take back some non-share consideration (it can be a note payable or cash) and shares of the corporation.

- Since this is an election, it must be filed with the CRA.

This will of course raise the costs of incorporation, but this is the correct way to transfer your business to your corporation and limit the risk of the CRA to deem this transfer as a sale at fair market value.

In summary, incorporating your real estate business really come down to your personal situation. Everyone is different and their reasons for incorporating are different also. Depending on your lifestyle, how much money you need to meet

your needs, and how much you earn throughout the year are all factors in deciding which route to take.

There is no simple answer, that’s why you should contact us at vikram@gulaticpa.com or call us at (905) 672-9972 for a free consultation and for any questions you

may have for incorporating your business!